The subject matter concerning more than 38 lakh pensioners ( Defence 19.4 Lakhs, Railways 10.18 Lakhs & Civilians 5.83 Lakhs) with financial liability at current rates being Rs. 30000 Crs. has been dealt with in Chapter 5 of the Sixth Central Pay Commission (CPC) Report. Contrary to expectations the Pay Commission has not suggested any change in the retirement age which would remain at 60 years.The recommendations also do not affect the employees having joined after 1/1/2004 since they are covered under the New Pension Scheme. The said scheme is also flexible in the sense that an employee can assure for himself higher retirement benefits by making contribution at higher rates and hence any additional benefits to the members of the new scheme were not found due.

Regarding the quantum of benefit ( Para 5.1.32) the recommendation is for retention of the existing formula of calculating pension as 50% of the average emoluments. However the Commission has felt that the existing system of payment of full pension only after completion of 33 years of service needs to be changed , since under this system an employee wishing to switch over to alternative employment continues to hang on to Government job merely for the purpose of ensuring full pension on retirement . It has suggested that an employee having rendered qualifying service of 20 years should be entitled to full pension . The pension should be fixed @ 50% of the average pay for last ten months or the last pay drawn whichever is higher.

For the existing pensioners the CPC has proposed additional pension being added @ 20% of the basic pension on attainment of age of 80, 85,90, 95 and 100 years.

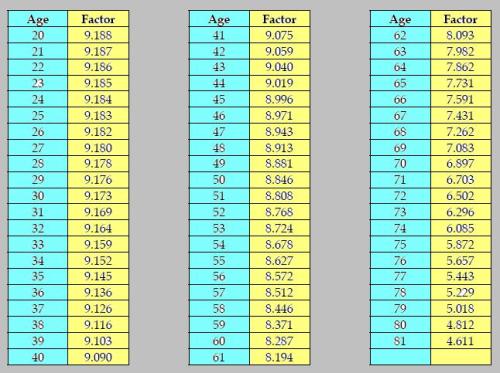

For payment of commutation amount the Commission has noted that various factors suggest that the procedure of restoration of commuted amount after 15 years appears to be more than fair. However the Commission has recommended the a new table (Annex.5.1.2) for calculation of commutation values.

(New Commutation Table)

It has also suggested that the business of commutation be passed on to PSU Banks/ Institutions as a routine financial activity. Commission has also suggested periodical review of commutation formula based on market interest rates and mortality rates.

For payment of gratuity the recommendation is for raising of pecuniary limit of Rs. 3.5 Lakhs to Rs. 10 Lakhs.

For leave encashment the recommendation is for allowing encashment of half pay leave (HPL) @ 50% of admissible leave salary also without any consequent reduction in pensionary benefits. However overall combined ceiling of 300 days for encashment of Earned Leave & HPL shall continue.

For family pension formula any changes have not been suggested except for the recommendation that the pension at enhanced rate would be paid for 10 yrs. (instead of 7 Yrs. for others) in respect of employees dying in harness. The admissibility ceiling of 25 years of age for unmarried daughters has already been removed. Further for medical benefit in respect of family pensioners the dependent children of widowed/ unmarried daughter shall be considered as part of family. The widowed daughter would also enjoy primacy of first category for benefit of family pension. Another major change suggested is that a childless widow shall continue to receive family pension even after her remarriage till her income from all sources exceeds the minimum pension payable in Central Govt.. This progressive gesture has been made to remove the factors which act as impediment in remarriage of such widows.

For cases of employees having accquired (100%) disability a provision has been made for payment of salary for constant attendant on pattern of Army Pensioners.

Amount of Ex gratia payable in case of accident in course of performance of duty has been doubled to Rs. 10 Lakhs and to Rs.15 Lakhs when the casualty is in an International war or due to natural disaster/acts of terrorism in a hard posting area.

The fitment benefit offered to existing pensioners would be 40% of the pension after excluding the merged portion of 50% dearness relief/dearness allowance . In the Table contained in Annexure 5.1.1 details of fitment benefit are available.

Later:The Finance Ministry have notified the recommendations for Pensioners as accepted by the Govt. along-with the details of conversion table. Click here for accessing the same,

Next Post: Is the debate over supremacy of IAS justified or of any relevance ?

For commutation values ,you have shown a table suggested by 6thCPC. Can you please give a specific example .

ReplyDeletewe can then understand

SKR

Clculation is quite simple. Proceedure is given in all handbooks on the subject.Sorry I did not see your comment earlier.

ReplyDeleteAny example for fixation of pay for persons promoted from 1-12-05 to date. Means any body gets promoted after pay commission becomes effective.

ReplyDeleteSir

ReplyDeleteA JCO in the Army who gets Hony Lt is placed in PB-3 of Rs 15,600/- with Gde Pay Rs 5400/- and MSP Rs 6000/- so to a total of Rs 27,000/-. As per Ch 2.3.30(Page 86) he will get one increment at the time of promotion as Hony Lt. So he will get Rs 15,600/- plus one increment.(What is the rate of increment is not known). As per Ch 5.1.61 his pension should be fixed as 50% of the last pay drawn or payable. But the pension chart shows pension which is very less than his entitlement. Pl clarify.

Thanks

A JCO in the Army who gets Hony Lt is placed in PB-3 of Rs 15,600/- with Gde Pay Rs 5400/- and MSP Rs 6000/- so to a total of Rs 27,000/-. As per Ch 2.3.30(Page 86) he will get one increment at the time of promotion as Hony Lt. So he will get Rs 15,600/- plus one increment.(What is the rate of increment is not known). As per Ch 5.1.61 his pension should be fixed as 50% of the last pay drawn or payable. But the pension chart shows pension which is very less than his entitlement. Pl clarify.

ReplyDeleteThanks

Mr.Saagr,Sorry I do not have the inclination /expertise for individual problem solving. Now since Cabinet has taken some decision you can wait for final instructions.Thanks for the visit,

ReplyDeletemy mummy was retird @ 31/03/2006, what will be her penion as per 6 th CPC, her old scale was 5000-15-8000 & on retirment her ber basic pay was 6500

ReplyDeletemy mummy was retird @ 31/03/2006, what will be her penion as per 6 th CPC, her old scale was 5000-150-8000 & on retirment her her basic pay was Rs. 6500

ReplyDeleteDear Sirs,

ReplyDeleteI am an ex-service man. I retired as Driver from Indian Army in 1986.

Now I receive a pension of Rs.1472 plus 50% DP (Rs.2208).

Then 47% DA on the above. The total I now get Rs.3246 p.m.

Now, I shall be glad to know what is my present Defence Pension.

Kindly let me know the details.

Thank you.

Regards,

P. Radhakrishnan

Army No: JC181767Y

ReplyDeleteRank : Hony LT

pension details required from August 2006 - till date and then January 2006 to July 2006 service payment.

Kindly send me.

Rgds

S Josephraj

Could I get the details of increment sal of x-amry force. I am very much thanks full if I get information about x-army pay scale after sixth pay commission.

ReplyDeletemy pay as on 1.12006 Rs.8125.retired on 31.5.2006.Whay would be my pay as on1.1.2006 and pension on 1.06.2006.my scale of pay 5500-9000.

ReplyDeleteR/sir

ReplyDeleteI am retired Rly Employee of 1st may 1994. Now my panssion is RS-6005/-.

What would be the present fixation in 6th pay commission?

Thanks.

P.k.Roy

Retd.Station Superintendant

My basic pension is Rs 4713/-. i retired as JWO from IAF on 30 Jun 07. pl let me know my new pesion & arrears. my basic pay on 01.1.06 was 5770/-

ReplyDeletePlease inform me about the terminal benefits including enhancement in Gratuity as per approved 6th CPC as I am due to retire on 31.12.2008.

ReplyDeletemy dady was retird @ 31/01/2007, what will be her penion as per 6 th CPC, his old scale was 5000-150-8000 & on retirment his basic pay was Rs. 6500

ReplyDeletemy father was retird @ 31/01/2007, what will be his penion as per 6 th CPC, his old scale was 5000-150-8000 & on retirment his basic pay was Rs. 6500

ReplyDeleteSir,

ReplyDeleteI am an Ex-Hony Lt retired on 29 Feb 2004 with a basic pension of 5250 (505 of Rs 10,500/- the pay of Lt). Presently I am getting 9000+ as my pension.

Kindly intimate me if I am entitled for increased pesion?

What is the effective date?

What is the likely monthly pension that I am likely to get?

Am I eligible for arrears of pension? If yes by how much (approximately)

I was retired on 28th February 2005 when my basis pay was Rs. 9100/-. After commutation, average emoluments were 13620/- and pension orgiinally sanctioned was Rs. 6810/-. How much will be the revised pension and from which date. Kindly assist me with this information.

ReplyDeleteThanks and regards

I am hony lt retired from service on 31 Mar 2008. My basic pension at that time was 5250/- what will be my present pension in 6th pay commison.

ReplyDeleteI am hony lt retired from service on 31 Mar 2004. My basic pension at tghat time weas Rs 5250/-. what will be my present pension in 6th pay commision.

ReplyDeletemy mummy is lt retired from service on 31/12/ 2007. her basic pension at that time weas Rs 6550/-. what will be my present pension in 6th pay commision.

ReplyDeletemy mummy is lt retired from service on 31/12/ 2006. her basic pension at that time weas Rs 6550/-. what will be my present pension in 6th pay commision

ReplyDeletefor commutation values ,you have shown a table suggested by 6thCPC. Can you please give a specific example .

ReplyDeletewe can then understand

To All those who have sought personal advice:This blog does not offer service of this nature.All instructions are available on the net . Please help yourselves.

ReplyDeleteMY FATHER WAS RETIRED ON 31/07/2000, ON1/01/2006 HIS PENSION WAS

ReplyDelete6508 &ON1/08/08 HIS PENSION WASRS. 7100, WHAT WILL HIS ARREAR & WHAT AMOUNT TIOAL PENSION HE WILL RECIEVE FROM 1/09/08

dear sir,

ReplyDeletei am ex-service man. i retired as postal assistant in december 2007.what will be my pension as per 6pc,at time of retirement my scale was 4500-125-7000 and my basic pay was 5600.

I retired on last 30 June, 2007 from an academic institute which is fully funded by the Govt. of India. As 6CPC was due on 1.1.2006 I feel I should get all the facilities of 6CPC such as Full Pension after completion of 20 years of service, Increased Gratuity, Earned Leave and other allownces provided by 6CPC and GOI because I was an employee of the Central Govt. upto last June 2007. But I am getting deprived from getting full pension though I already rendered yeomen service to the Central Govt. for more than 20 years. But as per the Notification ventilated on 2 Sept, 2008 the decision of the GOI gave me a great shock.There in the Notification it was clearly mentioned that employees who had retired on or after 1.1.2006 but before 1 September, 2008 would not be allowed to enjoy the facilities for full pension though they rendered service for 20 years. The Notification will be followed for the existing workers from 1 Sept, 2008 onwards if they serve for 20 years. But my question is, why is this anomaly still existing in GOI between the workers retired on or after 1.1.2006 but before 1.9.2008 and the existing workers from 1.9.2008 onwards. As the 6CPC was actually due on 1.1.2006 retirees on or after 1.1.2006 should also avail of the same privilege as that of the existing workers on or after 1.9.2008. I tenderely hope that GOI should do the proper justice to the workers/ employees retired on or after 1.1.2006 in the context of giving full pension who already rendered service to the GOI for 20 years or more on or after 1.1.2006 but before 1.9.2008.This is my earnest request as well as an appeal to GOI.

ReplyDeleteI also request GOI not to exploit the employees retired on or after 1.1.2006 from getting the previlege of full pension if they rendered service for at least 20 years.

ReplyDeleteI am a retired (VRS) JCO JC-758110M Nb Sub C. Perianayagam with effect from 01 Jun 2006. My basic pay scale was Rs 4899/-. Kindly inform me What will be my current pension scale details

ReplyDeleteThis post is now closed for queries

ReplyDeleteSorry Mr. Prasad . This blog does not offer this kind of service.

ReplyDeletesir i am ex-indian army 4 th gorkha rifles Jc-612037L sub indra bahadur gurung my battle casualtie dt-20 sep 2002 OP Parakram in J&K. my service from 31 Dec 1975-01Jan 2004. my Med cat-S,H,A3,P3(Perm) wef 17 July 2003. present pension draw is WIP(BC) how much my curent pension scale of 6PC. Pl Halp me sir Thanj You.

ReplyDeleteSir, I am EX-Indian Army of 4th Gorkha Rifles JC-612037L Sub & Hy SM Indra Bahadur Gurung, I am Battle Casualty in J&K (OP PARAKRAM) 20 Sep 2002. My Med Cat-S,H,A3,P3(Perm)E1. Wef 17 July 2003, My Army Service is from- 31 Dec 1975 to 01 Jan 2004 , 28 Years, I Recievd (WIP) Pension Pl help me how much my corrent Intetilment of 6PC Pension. I requist Thank You.

ReplyDeletewhoah this weblog is excellent i love studying your posts.

ReplyDeleteStay up the great work! You know, lots of people are searching round

for this info, you can aid them greatly.