Before and After the release of various reports of pay commissions, the responses in the society follow a set pattern. Initially there is a dreamy atmosphere in anticipation of benefits . All those who are connected to Govt. sector directly or indirectly relish the predawn signs on the horizon (news leaks on anticipated increase in pay) anticipating that their lives are henceforth going to be dfferent and a royal future awaits round the turn.

Their happiness is however short lived. There are a number of dependent sectors lead by owners of private educational institutions and stretching up-to the presswalla in the back lane who swoop upon the respective consumers in the entire society and start demanding respective pounds of flesh (sometimes at rates which are quite disproportionate to expected gains) without the flow of benefits having started and without any consideration of the fact as to whether the target group is going to benefit from any pay increase for Govt. Servants. The state of dreaming starts giving way to a state of uncertainty.

Thereafter the Press and TV follow up with insulting and insinuating headlines. All civil servants acquire the image of fat and lazy Babus comparable to a gang of bandits who are out to suck the life blood of economy. Screaming headlines announce doubling of pay packets for these suckers. Although the pay hike is for several other categories like armed forces, doctors ,engineers,nurses and technicians but it is the bureaucrat whose obese pictures adorn the covers of magazines as guzzler of currency notes. Dreams turn into despair when benefits are actually calculated and the jump in pay is found to be quite less than anticipated.

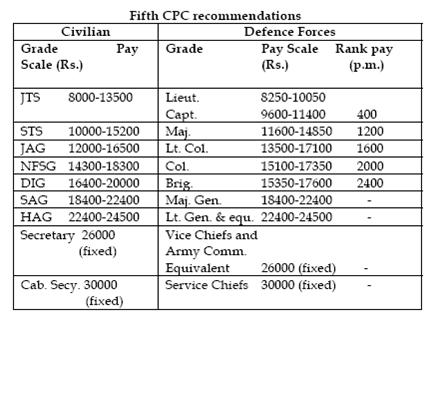

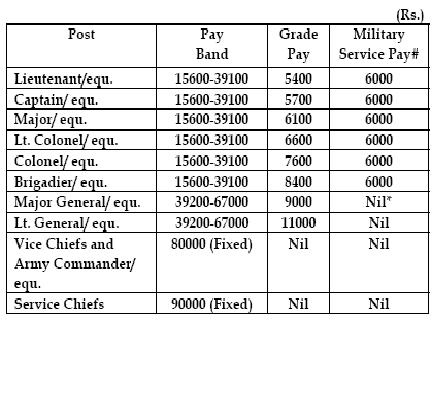

Another oft repeated scenario is that of berating the IAS for having again retained it's so called supremacy over other services. The service is projected in a dim light as unpatriotic for having deprived even the uniformed forces the reward of supremacy, ignoring their courageous performance against heavy odds. Media also reports on ( only a handful of ) cases of resignation from other services out of disgust (which may in fact be due to better retirement benefits offered by the pay commission). Although the various pay commissions despite reiterating the unique position of IAS have given ample financial benefits across the board to all categories including Army and professionals yet the news reports highlight only the so called favoritism shown to IAS.

The question which comes to mind is whether the controversy is at all relevant. In six decades of it's life span the Indian democracy has faced challenges of insurgency, natural calamities and elections with combined efforts of IAS, IPS, Army and professionals with dedication and single minded determination. Issues like who is superior to whom have never clouded the visions of the courageous men representing various organs of State at times of need .

While engaged in task of day to day governance the Government does need a nodal agency to coordinate efforts of various agencies and at that stage the generalist service whether IAS or State Civil Service has to shoulder the responsibility due to it's outreach, linkage and exposure over various fields. But this does not imply that these services assume the role of tyrant or dictator or the other services resent their so called superiority. Experience has shown that contrary to the media projections officer in various services do have a healthy feeling of mutual respect for other services and who is above whom is not a issue of long term significance.