Regarding Allowances other than Deraness Allowance, the Commission has offerd a mixed bag of benefits and also recommended some cuts in existing package .

(i) For City Compensatory Allowance which was being paid @ Rs.90-300/- for A-1 Category cities and at lower rates for A (Rs. 65-240/-), B-1 (Rs.45-180/-) & B-2 (Rs.25 -120/-) category cities to compensate for higher cost of living in these cities, the Commission has noted that the benefit provided is too low (1% to 5% of BP) and the criteria followed is not scientific enough to justify it's continuation. It has noted that Housing and Transport are two major expenditure heads in larger cities but these are being compensated enough under HRA & Transport Allowance. Abolition of CCA has been recommended.

(ii)There are several other Compensatotry allowances / Special Duty Allowances (SDA) payable to employees serving in difficult areas such as hill / border/tribal/ remote / hard / project areas and also payable to the employees serving in North East, Andaman & Nicobar and Lakshdweep Islands, Sunderbans and Gandhinagar and even a bad climate allowance for certain areas. The Commission has recommended for rates which are approximately twice of of the existing rates . Allowances for border area and Gandhinagar were found to be without justification and recommended for discontinuation. (pg. 234 Chapter 4).javascript:mctmp(0); . The SDA for North East would be payable to all categories of employees irrespective of the fact whether they have All India Service liability or not. Concessions of similar nature has also been recommended for Central Govt. employees serving in Ladakh reigon. Islands Special Duty Allowance (ISDA) presently payable to employees in Andaman & Nicobar and Lakshdweep Islands @ 12.5% and 25% shall continue to be paid at the same rates however from now onwards all employees would be entitled for the allowance irrespective of the consideration as to whether they have all india service liability or not. Employees serving in Nicobar Islands and Lakshdweep would get Hard Duty Allowance @25% over in addition to ISDA referred above.

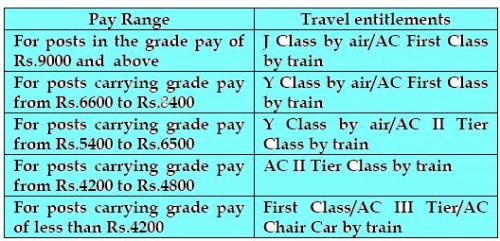

(iii) For travel on tour and transfer the following scale of admissibility have been recommended:

For travel outside the country the travel entitlements would remain the same. However the Commission has recommended that the benefits of mileage points earned by the government servants on official tours would be transferred to the respective departments (for utilisation for official tour of other employees). Utilization of these mileage points by the respective government servant for private journeys would invite disciplinary action.

For travel by road by means of public transport reimbursement to the extent of entitled class train fare is recommended.

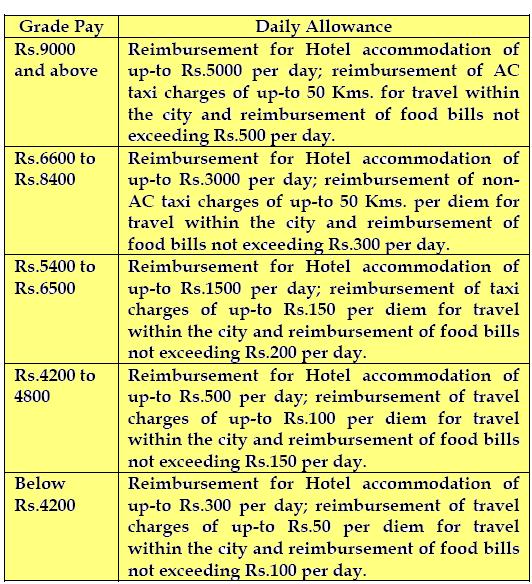

(iv) The Commission has noted that the present rates for reimbursement of daily allowances for officials on tours are grossly inadequate. The recommendations are as follows

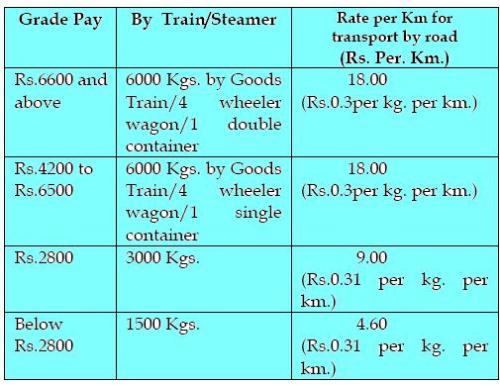

(v)The findings are similar for composite transfer grant payable to employees on transfer involving change of residence in public interest. It has been noted that some of the rates presently adopted are illogical and cause financial hardship to employees. The following rates have been recommended in order to rationalize the structure.

For employees serving in Andaman & Nicobar Islands any further concessions are not found admissible.

The Commission has made the rates for both the above cases dynamic i.e. the rates would increase by 25% whenever the the DA payable on revised pay increases by 50%.It has also suggested that in future the budget for travels should be kept to minimum and unnecessary travels should be avoided.

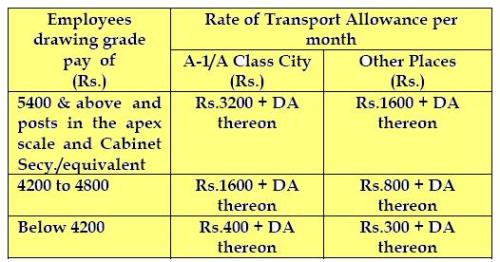

(vi) In respect of Transport Allowance the following revised rates are recommended to compensate for the increase in fuel cost.

The employees staying in official accommodation within proximity of workplace would also be entitled for this allowance. For the physically challenged employees the rates remain double of the rates subject to minimum of Rs.1000/- pm. The Officers in PB=4 have the choice to avail Transport Allowance @ Rs.7000/- pm on condition of giving up the facility of using official transport for traveling between home and workplace .

(vi) The Non Practicing Allowance (NPA) presently paid to Doctors in Govt. Service to compensate for loss of private practice has been recommended to be continued for historical reasons and also for the reason that the entry into govt. service is at a relatively late stage for medical professionals and also due to the reason that the working conditions are comparatively difficult. NPA shall be paid @ 25% of sum total of band pay +grade pay subject to ceiling 85000/- on this amount (BP+GP). NPA has not been found admissible for any other category of government employees.

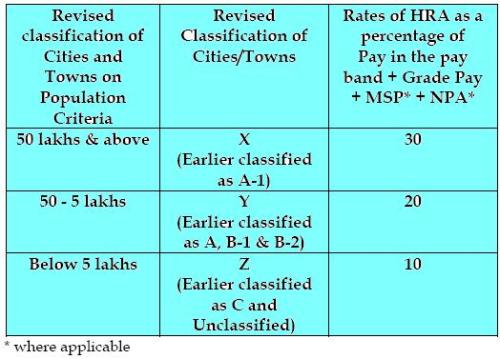

(vii) For considering the demands for increase in House Rent Allowance (HRA) the Commission has taken note of increase in rental values in smaller unclassified towns and attempted to mitigate sufferings of employees on this account by clubbing unclassified towns with Gr. C towns. The rates of HRA recommended are as below.

(viii) Commission has recommended for merger of Children education allowance with Tuition fees reimbursement. Henceforth reimbursement is permissible up-to Rs.1000/- for education and upto Rs.3000/- pm for hostel charges per child subject to ceiling of two children.

(ix) For employees in hazardous posts involving health risks ,the risk allowance has been discontinued and the employees are now proposed to be covered by free medical insurance ranging from Rs. 5 Lakhs to 10 Lakhs depending on respective category at govt cost .The insurance cover is proposed to be dynamic subject to 50% increase whenever DA increses by 50%.

(x) For Uniformed forces the revised rates of initial grant for uniform allowance shall be Rs.14000/- (Rs.16000/- for coast guards) against earlier rate of Rs.6500/-.Renewal is recommended every three years (instead of earlier 5 years) @ Rs.3000/- (Rs.5000/- for coast guards) .The rates of kit maintenance allowane for all other categories are also proposed to be doubled.

(xi) For all other allowance such as cycle, washing, cash handling, machine, Night duty, Split duty Allowances the rates are recommended to be doubled and shall be dynamic being linked to increase in DA as for other allowances mentioned at sl.no.(v) above.

(xii) The rates of Deputation (Duty) Allowance and Central (Deputation On Tenure) Allowance shall continue to be paid @ 5,10 & 15 % of the aggregate of pay and grade pay without any limits . However aggregate of grade pay and Deputation allowance should not exceed Rs.39,2000/- which is the starting pay for PB-4. The Central (Deputation On Tenure) will continue to be be payable only up-to Director level posts.

Next Post: Retirement benefits

Everything is fine

ReplyDeleteI think in the arrear calculation ,the sum of the arrear is not correct, you have to check it.

When the the next post for the retirement benefit will come up in your web-site.

Thanx for comments. If u kindly mention the precise error I may be able to recheck.

ReplyDeleteI held back the Next post on retirement benefits since interest in CPC report seems to be declining and also because now the report is being reexamined.I shall post the write up shortly.

ReplyDeleteYour calculation of arrears has to be with transport allowance also. There is a substantial increase in transport allowance.

ReplyDeleteI am a K.V. regular Teacher at Jorhat Assam with 12 years of experience. My native place is Assam.

ReplyDeleteAm I admissible the Special Duty Allowance as per recommendation of 6th pay Commission?

Whether deputation allowance is not given for he fifth year even though nothing has been mentioned in RRs. In IB, deputation allowance is given beyond five years. Please clarify

ReplyDeleteThis post is now closed for queries

ReplyDelete