The uppermost question in everyone’s mind is about the quantum of benefit which would accrue for respective categories of staff. As a starting point the increase in basic pay and arrears payable based on that may be discussed. The final benefits would be subject to approvals and modification by the Government.

A number of calculators are already available on the net and calculations made by them by and large approximate to the expected benefits. However a step by step calculation is attempted here for understanding the process.

For this exercise the following issues can be taken as settled:-

(i) The benefit would be admissible from 1st Jan. 2006 . Whether the whole amount is paid in cash or is transferred to savings would be subject to decision by the Central Govt.

(ii) The rate of dearness allowance payable (on date of pay fixation ) shall be equal to the difference between the rate of DA on 1st Jan. 2006 (24%) and rate as admissible on date of pay fixation. DA as on date is admissible @ 47% . The difference as on date is 47-24=23%

(Warning :Subsequent comments on this post indicate that this assumption may not be correct and a new formula based on a new index may be adopted, which will reduce the quantum of benefits)

(iii) The dearness allowance under the new scales shall be payable on basic pay +grade pay .

(iv) Arrears shall be calculated taking into account six monthly increases in DA for the intervening period as shown in the table above.

(v) The report visualizes accrual of increment on 1st July 2006 , 2007 & 2008 and one increment should accrue due to pay fixation from 01/01/06. Therefore minimum of three increments (=7.5% of basic pay as fixed on 1st Jan 2006) would have become due at the time of pay fixation.

(vi) Since increments are to be released @2.5% of the basic pay annually ,an increase of 7.5% (three increments) may be expected due to accrual of increments at the time of pay fixation.

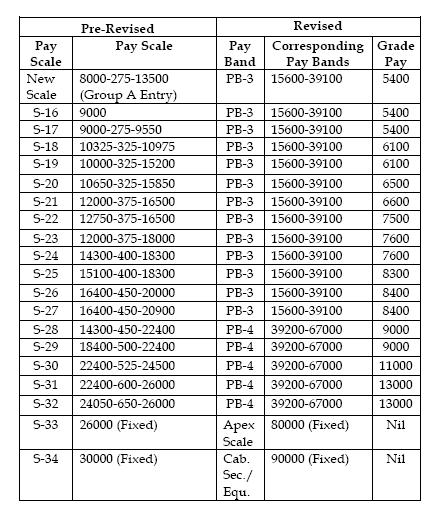

(vii) For the purpose of pay fixation the calculations are to be made by cross matching the basic pay being drawn with the pay and grade pay which would now be admissible with the help of table 2.2.2 shown at page 54 -70 Chapter 2 of the Report of Sixth CPC .

An illustration may be considered.

Let us consider the case of an officer in the pay scale of Rs.14300-18300 /- who is having basic pay of Rs.15500 /- at present. On 01/01/06 his basic pay would be Rs. 14700 /-. The table applicable to officers in the scale of Rs. 14300-18300 /-corresponds to Pay Band PB-3 which covers Gr. A Services of this category .

Salary under the old Pay Scales:Since at present the officer would be drawing basic pay of Rs.15500/-.Dearness Allowance calculated @47% on (Basic pay + Dearness Pay) would be payable . DA thus calculated is Rs10927/-.

Total pay on 01/01/08 under old Scale would be (15500+7750+10927)= Rs 34177/-

Salary under the new Pay scale:

As per the above table on 1st Jan.2006.the officer would be entitled to basic pay of Rs. 25580/- and grade pay of Rs. 7600/-in the new scale which would total to Rs 33180/- Increments @ 2.5% (Rs. 830/-)each would be due on 1st Jan. 2006 ( for pay fixation) , 1st July 2006 & 1st July 2007 .

Pay hike due to increase in rates of DA shall be @ 5% wef 1st July 2006 , @6% wef 1st Jan 2007, @ 6% wef 1st July 2007 and 6% wef 1st Jan 2008, Totaling to 23% on date.The following increase may be assumed in the pay of the employee

(i)Basic Pay + grade pay in new scale as on 01/01/06 =Rs. 33180/-

(ii) Adding three increments @ 7.5% (Rs.830/- eachX3)=Rs. 2490

(iii) Pay after adding increments =Rs. 36670/-

(iv) Increase in DA as payable @ 23% =Rs.8434/-

(v) Total Pay on Date in new Scale of Pay = Rs.45104/-

The monthly increase is coming in the range of Rs. 11000/- per month which appears to be a bit unrealistic. If any corrections are suggested, the same would be welcome. At this rate the arrears payable may be in the range of{ Rs.8000/- (average. diff in pay) X 30} which accounts for intervening two and half years.

(If we take only two increments in this period then the jump as on date may be in the range of Rs.9000/- pm only and average increase may be Rs.6500/- pm). Those desiring exact amount of arrears may wait for some time till reliable calculators are available on the net.

Alternatively by following the above method and calculating increase based on six monthly increase in DA and annual increment in pay details can be worked out .

Some Exceptions

(i) Promotion or change of Scale of Pay between 01/01/06 and fixation of new pay

Such employees would be allowed choice of refixation of pay from the date of subsequent change in the scales of pay and would get benefit of matching pay & grade pay.

(ii) Cases of new recruitments: Pay & Grade Pay of such employees shall be fixed at the lowest pay and grade pay in the corresponding pay band. However they will get benefits of increments. For calculating the number of increments the number of years required to move from the entry grade post in the pay band to the stage of pay in the recruitment scale shall be calculated as per DOPT OM Dt. 25/5/98 (or any amended instructions applicable on the date).Number of increments shall be equal to number of such years . (If it is a bit confusing pg.52 of Chapter 2 in the report may be accessed.)

Next post : Sample calculations for Gr. B,C & D employees.